Your business is booming, and you’re finally experiencing the fruits of your labour. Your customers are happy, which makes you especially pleased. Your objective is to keep your customers satisfied, and your business is in the perfect position to do so right now.

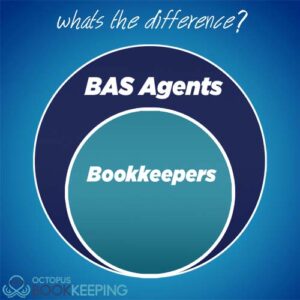

When the end of the financial year comes along, you’ll want to make sure that all of that client satisfaction translates into an equally satisfying balance sheet. You’ll need someone who can be trusted with your business’ money because you’ve been so busy handling inventory and sales. You are provided options when having your books monitored, such as hiring either a bookkeeper or a Registered BAS Agent. Whichever method you choose will have a beneficial influence on your business, but each has its own pros and cons. It all depends on your requirements. In this article, we’ll look at the differences between bookkeepers and BAS Agents and see how they differ.

Bookkeepers

There’s a strong chance you’ve already hired a bookkeeper and delegated accounting responsibility for your business. Your bookkeeper will be someone to whom you’ve entrusted your finances. Bookkeepers make sure your books are balanced at the conclusion of each quarter and at the end of the financial year. Transactions can be processed, reconciled, and reported by them. To expedite their day-to-day accounting activities, they usually use accounting software like Xero, MYOB or Quickbooks. They’ve become proficient with the software they commonly use. When year-end rolls around, this knowledge comes in useful because your figures must be accurate. Your accountant will devote less time to your accounts if your bookkeeper has your figures in order.

BAS Agents

A BAS Agent can do everything a bookkeeper can do, plus so much more. Registered BAS Agents can handle all of the bookkeeping responsibilities while flying a significant flag of differentiation. To use the title of BAS Agent, an individual must hold the necessary experience and certifications. In addition, the title of BAS agent is protected. Registered BAS Agents must adhere to certain standards and rules.

Similarities

Bookkeepers and BAS Agents typically handle the same kinds of activities. They report on the state of your business’ finances while ensuring the books are balanced appropriately.

Both BAS Agents and Bookkeepers can:

- set up accounting software (not including setup of default GST codes on accounts);

- entering transactions, tax invoices and entering data into accounting software that does not require analysis of BAS provision;

- general training with the use of accounting software not related to the client’s specific circumstances;

- Prepare bank reconciliations;

- prepare financial statements;

Bookkeepers and BAS Agents are essential to your daily accounting activities. Both can interpret the financial situations of your business and assist you, the owner, in making business decisions supported by their conclusions. Their function is to help you determine if your business is succeeding or if it requires a new direction to get back on track.

Differences

While there are no restrictions on the title of bookkeeper, not just anyone can operate as a Registered BAS Agent. Bookkeepers manage a handful of tasks, while BAS Agents can carry a more significant load. BAS Agents bring to the table the capacity to address matters relating to the ATO. Bookkeepers are engaged to look after the books, and that’s all. Bookkeepers are able to do many things related to business finances. However, Registered BAS Agents can do so much more, this includes:

- applying for an ABN on behalf of their client;

- entering transactions, tax invoices and entering data into accounting software that requires analysis of BAS provision;

- confirming figures to be included on an activity statement;

- completing and lodging activity statements;

- providing advice about or confirming the withholding tax obligations for the employees of a client.

- preparing and providing an income statement that may include reportable fringe benefits amounts and the reportable employer superannuation contributions;

- Registering or providing advice on registration for GST or PAYG withholding;

- Services under the Superannuation Guarantee (Administration) Act 1992 to the extent that they relate to a payroll function or payments to contractors;

- Advising about and SGC liability, including calculating the liability and preparing the SGC statement;

- Represent a client in their dealings with the ATO relating to the SGC – lodging SGC statements, being an authorised contact relating to SG and SGC and accessing these accounts in the ATO’s online services for BAS Agents;

If you require representation for your business to the Tax office on these matters, you will require the services only a BAS Agent can provide

Your business needs effective bookkeeping and GST compliance. While there are some parallels between bookkeepers and BAS Agents, the variances make it apparent that retaining a BAS Agent is the right choice. Registered BAS Agents tend to charge a little more, but in the long run, your decision will be unquestionably worthwhile.

If you require information on Registered BAS Agents or quality bookkeeping from one, don’t hesitate to contact Octopus Bookkeeping. We’d be happy to help you with all of your accounting needs.